WE THINK: Insights from a recent Gu Chaoming’s interview

- Category:偉志思考

- Edited by:Rabbit Fund

- Date:2023-07-07

Market rebounded a bit in June, with CSI 300 up 1.16%, slightly improved from previous five months. Market continued to be clueless of where to go, with AI-fevered themes showing weaknesses and retreating from peak – especially majority shareholder lowering its shares via divorce (Kunlun group had arrangements corporate actions similar to those of LeTV, triggering alarm to the market). Wind ChatGPT Index fell 5.59% in June, with an amplitude of almost 21%.

Mr. Gu Chaoming’s interview has gained popularity again in the industry – Mr. Gu made a speech under the topic “Japan’s Slowdown, Lessons Learnt, and its Influence toward China”, reviewing what happened in the past and made suggestions to what the Chinese authorities could do to save China’s economy. Mr. Gu’s speech was filled with research and understanding of the Japanese and Chinese markets. The comparisons and examples used were lively and practical; our last edition had touched on some points brought forward by Mr. Gu, and in this month’s edition, we would continue to explore based on his speech on topics related to China’s recent underperformance in various sectors:

1. Despite all the negative comments on how Japanese government treated its economy slowdown from its 1990’s peak (e.g. the lost decade, 20 years, 30 years etc.) GDP of Japan did not see a major downturn as compared to its peak in 90s, given asset bubbles like real estate and stock market collapse. From this perspective, we must admit Japanese were very successful in managing the crisis (as compared with -46% drop in GDP during the Great Depression period for US, under the backdrop where Japanese commercial real estate fell over 80%). In 1992 when housing prices begin to collapse, more and more families were bailing out their mortgage and lowering the leverage – with BOJ reducing its rates to zero didn’t boost much consumption. This is exactly the phenomenon described in Mr. Gu’s “the Great Depression Era”, where families no longer focus in maximizing their future gains or returns as their number one priority but minimizing debt. The fear of bankruptcy outplays the greed for consumption for the majority.

Then how did Japan get away from a major GDP downfall under such weak sentiment? Mr. Gu’s point of view is when the government begin increasing its leverage and spending that turned around the situation – to effectively let the savings flow in the money system, or what we call a “balance sheet recession”. He pointed out that, if the Japanese government focused in stimulus and policies development to increase spending, Japan could have recovered 10 or 20 years earlier from the devastating fall down.

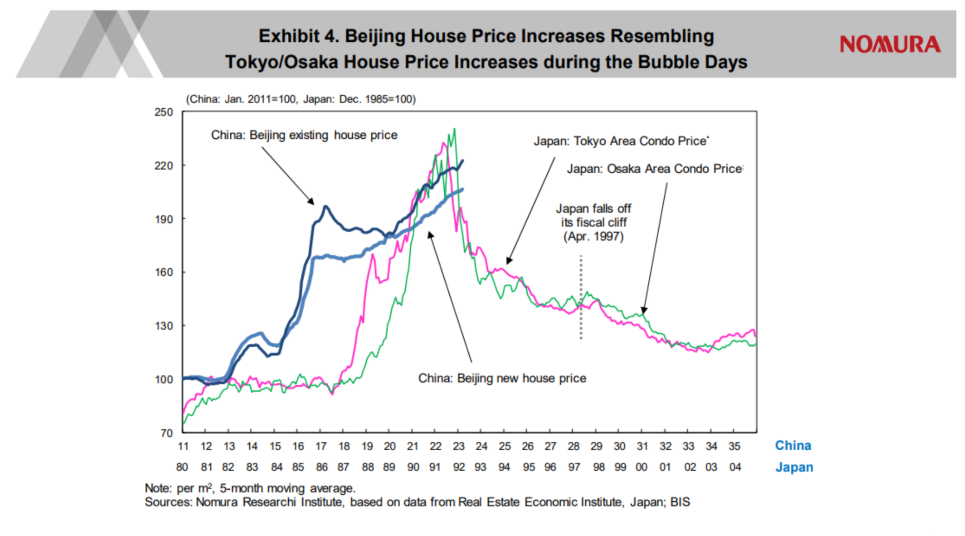

2. The graph above showed housing prices comparison between Beijing and Osaka. We could draw a conclusion that, if our housing markets follow such of Osaka’s, China may inevitably run towards a balance sheet recession just like Japan. Luckily we could use their experience for us to learn from. Many economist and authorities are already aware of the situation, and understands how to tackle the problem more effectively and efficiently: to save ourselves from the inefficient monetary policy or structural reforms but to put more efforts into financial supports to the real economy to revive its activities. By such, we can limit or minimize the damage from a balance sheet recession without hurting the country’s GDP too much.

In Mr Gu’s speech also made comparison between Japanese and Chinese corporate lending, and found an interesting fact that the deleverage actions actually started since 2015 (we believe 2015 & 2018 the highly leveraged, and later busted stock markets, played great influence). Real estate development currently weighs about 26% of the GDP, suggesting the perfect target to start stimulus with.

Geo-political tensions: Japan also faced unpleasant trade competition with US 30 years ago. A study Mr. Gu made himself by segregating the global economy into: westernized developed-market, non-developed markets and China. The GDP weighting are 54.8%, 26.8% and 18.4% respectively. He suggests that if such geo-political tensions continue, China would lose a majority of the 55% component of the world’s GDP, and forced to shift its target to the second criteria.

Population: Japan’s population decline started in 2009, or 19 years after bubble burst (although working population did not see much decline after its peak in 1992.). As for China, the turning point started in 2021, the same year asset bubbles burst and dampening much confidence towards future.

Conclusion: Mr. Gu used Japan’s 1990 to compare the situation for China of 2023. “Japan had two major challenges back then: 1. Asset bubble bursting, 2. Balance sheet recession coupled with trade tensions with US. Both very challenging questions to be answered, but were overcame through policy adjustments. For China, the adjustments could be a bit more complicated, because our balance sheet decline is coupled with real estate markets decline. But our biggest advantage is we already know how to solve the problems; Middle income trap is also a very serious issue and only a few countries have successful came out from it (Japan, Korea, Singapore, etc.) Political visibility or stability is also something to worry about for us Chinese. Last but not least, the post-COVID era financial issues for families are much more difficult as compared with families in the USA, as the US government provided more financial aid than China’s during COVID time.

Mr. Gu believes that the challenge China faces today is greater than Japan’s 30 years ago. He believes that the senior leadership should act swiftly to encounter the issues mentioned, believing this could be China’s chance to really step up towards best of the world in decades. It would be very unfortunate to see us fail at the juncture of time. He believes the problems could be solved, the challenges would be great but the Chinese would humbly and prudently overcome such issues.

We can see how passionate Mr. Gu is – with his dedication, depth of research and his compassion towards other Chinese, and hoping that the senior leadership could act swiftly to prevent the problems escalating.

Mr. Gu’s point of views might not be all correct or best, especially an aggressive and expanding government spendings may not have much difference as to what John Maynard Keynes suggests. What’s unique to Mr. Gu’s view is how he observes a balance sheet recession in a micro-economy way of thinking. The decline in internal consumptions and real estate markets are problems that are not new to the world, and therefore we believe China has a great chance to overcome such issues through learning from the history of others.

Market updates and investment strategies

A-shares has underperformed other markets in the first half of 2023. But the Shanghai and Shenzhen IPO financing figures were top of the list. This is a good thing to the capital markets as a whole, but not particularly favoring for stock prices. Together with a weaker than expected macro figures, the RMB has continuously declined, suppressing investors’ risk appetites. We should look forward to seeing how the second half would become.

But the lack of good news is also a common phenomenon when valuations are low. We always repeat our views that the stock price is an early reflection of the forecast of the economy – we understand what is the problem we are facing, we have seen solutions in how to solve such problems, what we need to do it believe in the senior leadership of the government to drive us out from the current situations with proper policies in place. “Believe what you see” or “Believing and seeing” are two very different logics, and the later are almost always more successful in making investment decisions.

And we are especially excited to see many great companies seeing price corrections and falling into attractive investment valuations! Spring season for investments does need a lot of patience. For the first half of 2023, short term trading and thematic investments dominated the performances, but we believe market has its cycle – understanding the cycles are crucial otherwise one would be chasing the cycles instead of riding through it (as we see how many suffered from consumption and new energy investments now, which were the most popular investment themes back in 2020 and 2021).

For investment strategy, we could continue to keep a middle-to-high position for our portfolios, and start to rotate in quality names for future investment alpha.

Best Regards,

Wu Weizhi

July 2nd at Interlaken - Switzerland

本期《偉志思考》簡體中文版鏈接:

伟志思考:辜朝明最近演讲给我们的启示

WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09WE Think — The Hardest Part of Investing: What to Do After Missing the Rally

In the current market environment, consensus on a bull market is gradually strengthening. The A-share market showed significant acceleration in August

2025-09-01WE Think:Why can't you make money in bull markets?

In July, A-shares delivered robust performance across key benchmarks, with the Wind All A Index advancing 4.75%, the CSI 300 gaining 3.54%, and small-

2025-08-04