In August, the A-share market experienced a significant decline. The CSI 300 Index fell by 6.21% for the month, marking the largest monthly decline this year. Despite a series of positive news following the Political Bureau meeting on July 24, foreign capital continued to flow out, with a net outflow of 73.996 billion yuan in August, setting a new record for the highest monthly net outflow. On August 25, the Shanghai Composite Index hit a new low at 3,053.04 in 2023, and the ChiNext Index also fell by 13% since the beginning of the year. Various media outlets and articles were filled with jokes and discussions about the "battle for defending 3000 point" for the umpteenth time, creating a pessimistic and even desperate atmosphere among investors.

The news in August exhibited a clear combination of both positive and negative aspects, with bad news at the micro level and good news at the macro level emerging one after another. At the micro level, there were instances of major private real estate companies defaulting on their debts, large trust and wealth management companies experiencing defaults, a decline in real estate sales data, and a year-on-year decline in listed companies' performance. At the macro policy level, after the direction was set at the July 24 meeting, the Ministry of Finance announced a halving of stamp duty, the China Securities Regulatory Commission announced control over the pace of initial public offerings (IPOs), new regulations on controlling shareholders' reduction of holdings, the People's Bank of China lowered loan interest rate benchmarks, lowered reserve requirements, required commercial banks to lower interest rates on existing housing loans, large commercial banks reduced savings deposit rates, and announced that the purchase of a first home does not require proof of loan, and lowered the down payment ratio for first homes to 20% and second homes to 30%... It is rare to see such dense series of policy release within such a short period of time. What will be the effects on the real estate and the economy? We will discuss this in another article, but at least it demonstrates the decision-makers' attention to and urgency in addressing the economy.

Yet many investors flocked to other safe havens, given all the good news and policies announced. Why is this happening and what’s the logic behind? What kind of risks and chances are we facing in the current capital markets?

How Did Listed Companies Do In 1H23?

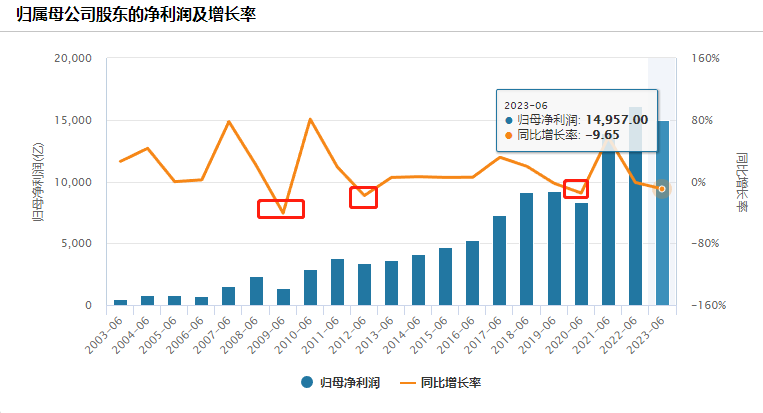

As of August 31, out of the 5,266 listed companies, 5,265 companies have disclosed their financial data for the first half of 2023 as required. The overall performance of A-share companies has been under pressure. In the first half of the year, these 5,265 listed companies achieved revenue of 35.36 trillion yuan, a year-on-year increase of 2.57%. However, their net profit attributable to the parent company was 2.95 trillion yuan, a decrease of 4.32% compared to the same period last year. If we exclude financial and energy companies, the remaining A-share listed companies achieved revenue of 27.42 trillion yuan, a year-on-year increase of 3.48%. Their net profit attributable to the parent company was 1.496 trillion yuan, a decrease of 9.65% compared to the same period last year.

The chart above shows the year-on-year data for A-share companies excluding financial and energy sectors over the past 20 years. This year's mid-year report is clearly not impressive, but in historical context, it is not the worst. There have been three instances in history with more severe negative growth: 2009, 2012, and 2020. In 2009, everyone knows it was the impact of the financial tsunami triggered by the U.S. subprime mortgage crisis. Later, under the 4 trillion yuan stimulus package, the situation quickly turned around. In 2020, the situation was clear to everyone, with the temporary economic pause caused by the need for epidemic prevention measures.

In 2023, there is no severe external crisis or impact from the pandemic, so the most comparable situation would be 2012. Let's review the subsequent developments in the capital market and the economy after 2012. At the end of 2012, the start of a three-year bull market for the ChiNext board occurred, and in the second half of 2014, the market entered a comprehensive bull market phase. Although this bull market, the subsequent leveraging, and deleveraging efforts were a bit excessive, resulting in volatile market fluctuations, that is a separate matter. However, by the end of August 2012, when the mid-year reports were released, the new bull market was not far away.

China has over 52 million small and medium-sized enterprises (SMEs), and only 5,266 have the privilege of becoming listed companies. It can be said that each listed company is a leader and industry powerhouse, representing the strongest competitiveness and profitability in their respective industries. If even the most profitable group of listed companies in China is under pressure in the first half of 2023, it's not difficult to imagine the business conditions of the other 52 million SMEs. In August, the year-on-year data for land auction transactions in various regions showed a significant decline, indicating challenges for businesses, employment, and local government finances. There is often a time lag between the micro-level perceptions and macro-level data because macro-level data can only be presented after all micro-level data is consolidated. This is probably the difference between the micro-level experience and macro-level data that the spokesperson of the National Bureau of Statistics mentioned. Why did friends around us begin to feel the pressure of operations in the second quarter, but the macro-level data still appeared relatively healthy? With the culmination of various data by the end of August, the current macro-level data should reflect the difficulties at the micro-level quite well.

Here, we are not saying that this time will definitely lead to a bull market like the one after 2012. We just want to express that poor economic data for the current period is not necessarily all negative. Data reflects the recent past, and the most important aspect of investment is the future. Faced with bad data in reality, individuals with a first-level thinking mindset may think that since the data is bad and the situation is dire, they should quickly sell their stocks for safety. The recent net selling by foreign investors and many investors rushing to cut losses may be in line with this thinking. Individuals with a second-level thinking mindset may think that the situation has reached such a level, and the Central Committee of the Communist Party of China has already recognized the problems and started to take targeted measures. With proactive fiscal policies, loose monetary and credit conditions, and real estate policies shifting from suppression to relaxation, if winter has arrived, will spring be far behind? From the recent weak market trend, there are some investors who hold this viewpoint in the short term, but they are not in the majority.

The Phase Between A “Policy Bottom” And “Market Bottom” Is Often Considered The Darkest Moments For Most Investors

I have joined the capital markets for 30 years since 1993, and I have experienced five bear markets during the period, with this counting as the sixth. I have clear memory and some thoughts of a the characteristics of a bear market, the corresponding economic conditions during this period, and the reactions from investors.

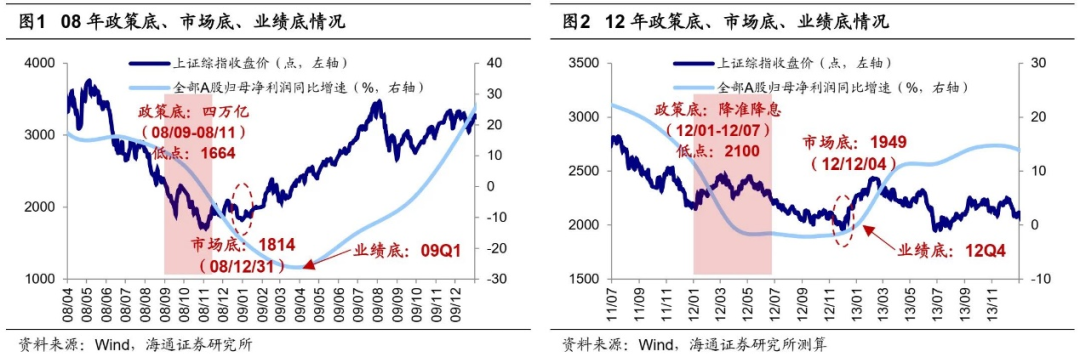

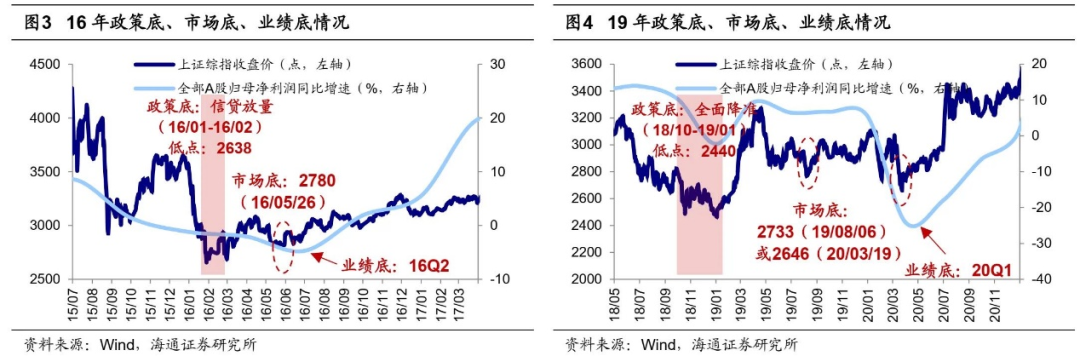

Recently, Dr. Xun Yugen, the Chief Strategist of Haitong Strategy, also wrote a report titled "Historical Review: Policy Bottom, Market Bottom, and Earnings Bottom." I personally find some of the research conclusions in the report quite agreeable. The report points out that "looking back at history, policy bottoms, market bottoms, and earnings bottoms occur sequentially in terms of time." This viewpoint aligns with our constant emphasis on the "policy as the locomotive, the capital market as the train body, and the real economy as the train tail." The logic and perspective are completely consistent.

When reviewing the government interventions during the later stages of past bear markets, our colleagues have conducted empirical research on whether there are new lows after the policy bottom. It has been observed that both scenarios, with or without new lows, have occurred, but the magnitude and duration of new lows have not been very long in historical context. Dr. Xun believes that whether there will be a lower market bottom depends on the comparison between the strength of policy measures and the downward pressure on the fundamentals. If the strength of policy measures exceeds the downward pressure on the fundamentals, then the market bottom will be higher than the policy bottom, as seen in 2008, 2016, and 2019. If the strength of policy measures is lower than the downward pressure on the fundamentals, then the market bottom will be lower than the policy bottom, as in 2012.

Economic downturn pressure: The pressure of this economic downturn is particularly prominent compared to previous ones. Since the second quarter, the slow recovery of domestic demand combined with weakening external demand has led to a slowdown in the domestic economy. Real estate sales and local government land sales have hit new lows, and many local government officials and employees in public institutions, as well as employees in the financial sector and real estate industry, have experienced salary reductions. Expectations for employment and income have weakened, and this has begun to affect consumption.

Policy measures: The Political Bureau meeting on July 24th called for "increasing the intensity of macroeconomic policy regulation." Recently, policies in various fields have been continuously introduced and implemented. In the real estate sector, on August 25th, the People's Bank of China and the Ministry of Housing and Urban-Rural Development issued a notice to promote the policy of "recognizing houses without verifying loans" for first-time homebuyers. On August 31st, the People's Bank of China and other departments released a notice to lower the down payment ratios for first-time and second-time homebuyers and reduce the interest rates on existing first-home mortgages. In the capital market, on August 27th, the China Securities Regulatory Commission introduced multiple policies to optimize IPO and refinancing supervision, regulate share reduction behaviors, and so on. On the same day, the Ministry of Finance and the State Administration of Taxation announced that starting from August 28th, 2023, the securities transaction stamp duty would be halved. Based on recent actions, the scale and intensity of the current policy measures to stabilize the market are quite high. Xun Yugen believes that this round of policy bottom started in April 2022 (there may be different views in the market). Recently, some leading economic indicators have shown signs of stabilization. For example, the manufacturing PMI has rebounded for three consecutive months since May, rising from 48.8% in May to 49.7% in August. The year-on-year decline in industrial enterprise profits has narrowed from -22.9% in February to -15.5% in July. The month-on-month change in the producer price index (PPI) hit a bottom of -5.4% in June. Such strong policy support to mitigate the pressure of economic downturn is relatively rare.

Entering August, many investors have become more pessimistic and desperate. Of course, there are considerable investors whose stock or fund portfolios have suffered significant losses, nearing their psychological limits. Investment goals and mindsets have undergone significant changes, from the previous big dreams to now salvaging whatever is left or otherwise nothing else would be left. This may be why many people are now in a rush to sell their stocks and redeem their funds to exit the market in the late stages of a prolonged and severe bear market. From my personal experience, government has been clear in supporting the capital markets now. Another reason for the increasing despair is the belief that if so many positive factors have emerged but the stock market is not rising, it indicates that the market and the economy are truly poor, and it is better to cut losses. Whether these thoughts and actions are right or wrong needs to be judged over time. From my experience, during particularly optimistic or pessimistic stages, if we continue to think in terms of extrapolating trends, it is easy to make strategic mistakes. It should be noted that there has already been a significant reversal in policy support, and we believe that positive changes in the stock market and corporate profits will be seen soon.

Regarding the establishment of a policy bottom, I believe there is a consensus among the majority. Many people are still unsure about whether the market bottom has been reached or if there is a possibility of even cheaper prices in the future. Perhaps there is or perhaps there isn't. We believe that this is not the key issue. If we pursue perfection and try to time the market to buy at the lowest point with all our funds, aiming to be the most handsome investor in the market, there will be no end to it. Here, we would like to share a phrase we have repeated many times: "Don't miss out on what is right in pursuit of perfection!" The correctness of the strategy is more important than tactical perfection.

Recent Investment Strategies

The main points discussed at our mid-term strategy meeting on August 9th emphasized maintaining a proactive and enterprising investment strategy in the current stage. With the policy bottom already clear, the market bottom may be right at our feet. While it may seem like a desperate and dark moment for many, it is also a time of new opportunities and rejuvenation. There is no need to be more pessimistic.

Select high-quality assets with solid fundamentals and secure valuations for long-term investment. Have patience and hold your positions without rushing for quick gains. Wait calmly for better times to come, just like waiting for the arrival of spring when flowers bloom. Believe that only those who persist in sowing seeds during the coldest spring season are likely to reap abundant fruits in autumn.

Best Regards,

WU Weizhi

Sep 3rd, 2023

本期《偉志思考》簡體中文版鏈接:

伟志思考:再一次到了多数投资者绝望的至暗时刻

WE Think: How should we view the sharp rises and falls in gold and silver prices? Is the new Fed chair hawkish or dovish?

At the start of 2026, global politics, economics, geopolitics, commodities, and capital markets have experienced dramatic fluctuations, with many even

2026-02-02WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09