2024 Outlook:Is 2024 going to be better? Or not?

- Category:偉志思考

- Edited by:Rabbit Fund

- Date:2024-01-10

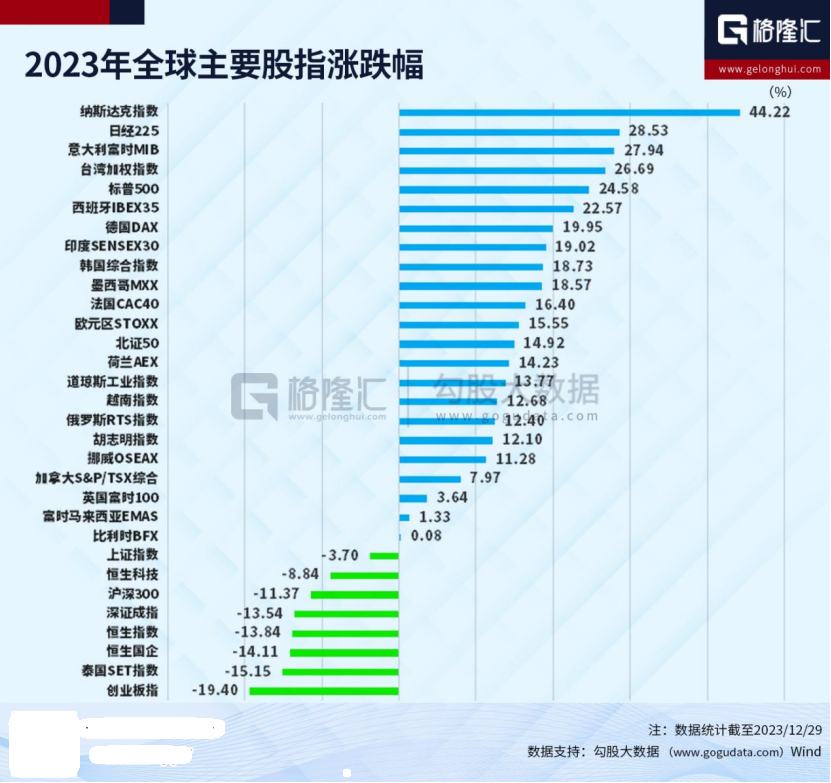

As the New Year bell rings, 2023 has become history. Looking back at the past year, the major capital markets in the United States, Europe, and globally did not experience the massive collapse that most investors feared at the beginning of the year, despite the Federal Reserve's continuous interest rate hikes. Instead, it turned out to be a fruitful year, with the Nasdaq rising by 43.42% and the S&P 500 increasing by 24.23% throughout the year. The Nikkei 225 index rose by 28.24%, and India index saw a rise of 18.74%. In contrast, the performance of the Chinese capital market this year ranked the last among the major economies worldwide. The CSI 300 index fell by 11.38%, and the Hang Seng Index declined by 13.82%. The CSI 300 index recorded three consecutive years of decline for the first time in its history, while the Hang Seng Index experienced its first four-year consecutive bearish trend since its establishment in 1964. For most investors who held Chinese assets, the past year was quite painful and challenging. Will 2024 bring a reversal of fortune or continue to move towards the abyss?

What has confused many investors is that in 2023, China continued to lower interest rates and reserve requirements, while the United States continued to raise interest rates. According to conventional wisdom, interest rate hikes are not favorable for the capital market, so there should have been downward pressure on the U.S. stock market in 2023. Monetary policy easing through interest rate cuts and reserve requirement reductions is beneficial for the valuation of the capital market. However, why did the A-share and Hong Kong stock markets continue to decline in 2023? Upon careful consideration, relying solely on interest rate changes to make predictions about stock market movements is not a robust logic. There are many factors that influence the rise and fall of the stock market, and interest rates and monetary environment are just two important factors among them. If a model ignores other factors and establishes a single-factor model based solely on interest rates, it is evidently unscientific. It at least overlooks important factors such as corporate earnings and the supply-demand relationship in the capital market.

At the end and beginning of the year, it is an unavoidable and important topic to review the main factors that have influenced domestic economic activities and the capital market over the past year, and to summarize the gains, losses, and underlying reasons in investment. It is essential to reflect on the opportunities and challenges of the new year. Therefore, recently I have secluded myself and extensively read various articles and reports, contemplating deeply. Gradually, I have gained a clearer outline of the development of important factors and various potential changes in the capital market that affect the current and upcoming year. In this year-end and New Year outlook, let's discuss these issues. It may help us understand the reasons for the weakness of China's capital market in 2023 and provide a clearer perspective on the future trends of the economy and the capital market.

Economic observations in 2023

Real estate is a key driver of macroeconomic prosperity and the impact of local governments’ fiscal difficulties should not be underestimated.

Real estate, with its characteristics of durable consumer goods for housing and investment assets, has significant implications for short-term economic fluctuations, mid-term transformation, long-term development, and financial stability in China. The sharp fluctuations in real estate investment and prices in the short term may aggregate business operational risks, household balance sheet risks, fiscal risks, and financial risks to some extent.

In the past, the cycle of "real estate-land finance-finance" has made significant contributions to China's economic growth. The real estate and related industries account for about 25% of the domestic GDP, land transfer fees account for about 40% of local government revenue sources, and real estate loans and loans secured by real estate account for about 40% of the underlying assets of financial institutions. This year, there has been a significant decline in real estate sales area, sales value, new construction, and land auction data. In the short term, the real estate market still faces a cycle of "price decline - weak sales - difficult collection - reduced land acquisition - declining investment". This round of real estate downturn, which started in the second half of 2021, has now entered its fourth year in 2024. Although it is not as long as the downward cycle in Japan in the 1990s, it is still longer than many expected.

Since the beginning of this year, policies aimed at stabilizing the real estate market have been frequently introduced from the central to local levels. According to data from Zhuge Data Center, as of December 18, 2023, local governments have issued loosening policies 751 times, an increase of 140 times compared to last year, covering over 330 cities. Looking at these data, the situation feels very complex. Including the 25 financial support policies for private enterprises issued by the central bank and the China Banking and Insurance Regulatory Commission, it seems that the quantity of policies is sufficient, but the effects have not been seen yet. Even Vanke, the best-performing student in the class, experienced declines in both stocks and bonds, forcing major shareholders such as Shenzhen Metro and Shenzhen State-owned Assets to come out and support market stability. The quantity of policies seems to be abundant, but the key lies in the strength and implementation of the policies! It is difficult to control the upward trend and even more challenging to support the downward trend. It seems that squeezing toothpaste hesitantly may not truly understand and think clearly. Hopefully, in 2024, we will see the emergence and implementation of real estate policies with real strength.

Perhaps in the past, including ourselves, most people underestimated the systematic impact of local fiscal difficulties on the economy. In 2023, during our research on certain industries and listed companies, we observed that local policy and fiscal difficulties have led to significant declines in the orders and revenue of many listed companies related to local construction, information security, healthcare, and defense industries. For those companies whose orders are still intact, the ability to collect accounts receivable has become a burden. Those familiar with economics know that one party's expenditure corresponds to another party's income. Local fiscal difficulties have led to salary reductions for local civil servants and public institutions, as well as tightened spending by local governments, which is having an undeniable contractionary effect on overall economic activity. The difficulties in local fiscal finances are the result, and the challenges in selling land during the downturn in the real estate market are the cause. The essence of these two problems may be connected. It seems that there are many problems, but if we address the key issue, other problems may be resolved easily. How the situation evolves ultimately depends on determination and strength of the policy.

Employment-Income-Consumption: Can a virtuous cycle be formed in 2024, with the total wealth and income of residents as the cornerstone of domestic demand?

Whether it's the recent meetings of the Political Bureau or the Central Economic Work Conference, it has been pointed out that "insufficient domestic demand and weak expectations" are the main problems and difficulties facing the domestic economy. In 2023, the main problem faced by major economies in Europe and the United States was significant inflationary pressure, while we faced deflationary pressure with insufficient demand and excess capacity in most industries. Apart from the fact that we have adhered to fiscal discipline and refrained from indiscriminate money printing and distribution to residents during the epidemic period, what other factors have led to the stark contrast between the deflationary situation at home and abroad?

With the deep adjustment of the real estate industry, many companies in the real estate industry chain are facing difficulties in operation. Layoffs and salary reductions are very common. In addition, the financial sector's risk reduction measures and the impact of the previous false prosperity brought by financial speculation have led to a comprehensive contraction in employment positions in shadow banking. The continued increase in the vacancy rate of office buildings in first-tier cities is also to some extent affected by these factors. After the introduction of the "dual reduction" policy, there has been a significant reduction in employment positions in the education and training industry, and internet giants have shifted from expansion and hiring mode to downsizing and cost-cutting mode. Although the booming new energy vehicle, battery, and photovoltaic industries have created many job opportunities, the employment expectations of residents are still weak. In terms of income, there have been constant rumors of "salary cuts" in many fields, and even some financial institutions have experienced the phenomenon of "reverse salary negotiations." Income is the foundation of consumption, and based on tracking the data of listed companies in the consumer industry in the third and fourth quarters, the downward trend in business activity has not been completely reversed.

The key to the impact of property income depends on housing prices and stock prices. The downward trend in housing prices in 2023 is something that everyone can see with the naked eye. The differences in statistical calibers and observation perspectives only reflect the difference in the magnitude of the decline, but the direction of the decline is believed to be undisputed. In my city, Shenzhen, the prices of most properties have adjusted by around 20-30% compared to the peak bubble period. As for the stock market, the Shanghai and Shenzhen 300 Index has declined for three consecutive years, and the Hang Seng Index has declined for four years. This round of deep adjustment in the real estate market has not had a significant direct impact on large state-owned banks, but it has dealt a devastating blow to shadow banking. The devaluation of wealth among the high-net-worth individuals who provided funding for trust companies and other shadow banks and third-party wealth management companies in the country cannot be ignored in terms of its impact on consumption and investment. Some high-net-worth individuals have begun to adopt a belief in staying away from speculative investments and reducing their risk preferences and return expectations to preserve their wealth. In 2024, in order to form a positive cycle of employment-income-consumption, in addition to increasing employment and stopping salary reductions, it is also urgent to stabilize housing prices and stock market prices and reverse the downward trend in property income.

The contraction effect of financial risk reduction largely offsets the expansion effect brought by interest rate cuts and reserve requirement ratio reductions.

The risk reduction and governance in the real estate sector and shadow banking are necessary and correct measures to prevent systemic risks. In a sense, they are doing painful but correct things in the short term. If high-risk financial institutions are allowed to continue their disorderly expansion, it would go against the goal of adhering to high-quality development proposed by the central government. Currently, the "risk reduction" in the financial sector may not have completely ended yet. The risk reduction over the past few years has brought about some contraction effects and negative impacts on the economy, which have partially offset the expansionary effects of the central bank's interest rate cuts and reserve requirement ratio reductions. This may be the reason why monetary policy seems to be very loose, but many enterprises still face a lack of funds. According to the spirit of the central meetings, the risk prevention work in 2024 will mainly focus on real estate, local government debt, and small and medium-sized local banks. In a sense, the risk disposal work of the domestic financial system has entered its final stage.

A significant reason for the weakness of the capital market in 2023 is the failure to form a virtuous cycle of "commodity prices - corporate profits - stock market valuation". Domestic prices have continued to weaken in 2023 and are on the verge of deflation, with the year-on-year CPI turning negative again in October. The sluggish prices have squeezed the profit margins of enterprises and even caused losses.

The challenges and rebalancing brought about by deglobalization

Since the initiation of the trade war by President Trump in 2018, coupled with the impact of the pandemic in the following three years, the global trade environment has undergone significant changes. In industries where China has achieved technological breakthroughs, Chinese companies have emerged as dominant players, surpassing their counterparts from other countries. China accounts for 70% of the production capacity of the top 160 traded goods globally. Even in automobile exports, China surpassed Japan in 2023 to become the world's largest automobile exporter. Furthermore, in the field of new energy vehicles, China has successfully overtaken traditional automotive powerhouses such as Germany, Japan, and the United States, possessing the most comprehensive and competitive new energy vehicle industry chain. In the solar industry, China also maintains a significant technological and cost advantage, with 90% of the industry's capacity concentrated within its borders. Additionally, China's investment in research and development and its progress in technology outpace global competitors.

In the face of highly competitive Chinese companies, how can the international division of labor and global trade continue to evolve? Without a certain mechanism for rebalancing, there is a concern that global wealth and employment will flow rapidly to China, which would be difficult for any country to accept. Therefore, in recent years, we have seen an increase in trade protectionist policies from some Western countries, many of which are targeted at Chinese manufacturing. Regarding the China-US trade relationship, after multiple rounds of negotiations and communication, the Biden administration's recent summit with Chinese leaders in San Francisco seems to have established a new balance mechanism. "Decoupling" has become a consensus between the two parties, especially as the conflicts between Russia and Ukraine persist and new instability arises in the Middle East, the United States has fully recognized the importance and necessity of maintaining stable relations with China. Under the combination of high tariffs on Chinese goods and restrictions on China's progress in high-tech fields such as semiconductors and AI, the US concerns about China's continued rapid catching-up have somewhat diminished, and with an increased sense of security, the two sides seem to have reached a state of rebalancing. Their relationship has shifted from the previous expectation of complete decoupling to a phase of relative stability.

Observing many listed companies involved in the international division of labor, they are actively promoting transformation to adapt to this new pattern of international trade. Overall, the focus is shifting from "Made in China, sold globally" to "Made globally, sold globally." Although venturing into international markets presents significant cultural and management challenges, the risks of being left out by not expanding internationally exist, as demonstrated by the experiences of neighboring East Asian countries. In terms of operations and management, inevitable cost increases and decreased return on equity (ROE) may occur, but when weighing the two evils, it is essential to actively expand into international markets to adapt to the new landscape of global trade. In Japan, many companies that achieved internationalization were the ones that experienced significant growth in the decade after the 1990s.

We have always believed that the economy and capital markets are complex systems, involving various micro-entities such as governments, central banks, enterprises, and residents, each continuously inputting variables into the system, all of which are dynamically changing. The economy and capital markets are not like computer programs that are pre-programmed to run according to a predetermined set of instructions. Therefore, overly certain and faithful predictions should not be made in advance. Looking back at history, the evolution of the world has never unfolded exactly as some wise individuals had precisely predicted in advance. Therefore, in 2024 and future years, there are countless possibilities for how things may unfold. It is not necessary to make overly specific predictions about the distant future. "Adaptation is more important than prediction" is an important principle. While businesses and investments require some level of prediction, it is even more crucial to adjust and adapt in a timely manner according to changes.

2024 Outlook

In 2023, China's capital market still had some bright spots. In terms of IPO fundraising rankings, the Shanghai and Shenzhen Stock Exchanges surpassed all their competitors and ranked among the top two globally. The IPO fundraising rankings of the top five exchanges globally last year were as follows: Shanghai Stock Exchange raised $27.1 billion, Shenzhen Stock Exchange raised $20.2 billion, Nasdaq raised $11.4 billion, New York Stock Exchange raised $10.7 billion, Mumbai Stock Exchange raised $6.6 billion, and Hong Kong Stock Exchange raised $5.5 billion. Although IPOs slowed down after the political meeting at the end of July, the stock supply quantity has significantly increased in the past two years, leading to an imbalance between supply and demand and contributing to market weakness. Fortunately, the regulatory authorities have recognized this issue and implemented targeted policy measures.

Due to the continuous decline of blue-chip stocks over the past three years, many A-share investors and fund holders have had a negative investment experience, especially for those who entered the market during the hot-selling phase of funds in the second half of 2020. The funds that were popular during that period focused on consumer and new energy themes, and in the past year, these types of funds have experienced the largest decline, resulting in significant losses for investors. By the end of 2023, many investors have reached their psychological limits. Various grand narratives have started to prevail once again, and there is an increasing trend of investors cutting losses and staying away from the stock market.

Will 2024 bring a turn for the better, or is this time really different?

The economy has its cycles, and the stock market is no exception. Studying the rules of the stock market is different from studying the rules of the economy. Many excellent economists have also failed in stock market investments. The rules of the stock market should be studied and respected. Going against the rules of the stock market will continue to be a costly lesson!

Trend extrapolation is a rule of the stock market, and the turn from a downturn to prosperity and from prosperity to decline is also a rule of the stock market. When observing most people, more investors tend to accept trend extrapolation but find it difficult to accept the turn from a downturn to prosperity and from prosperity to decline. The reason is simple: it takes more courage and professional ability to make the different choices as the majority, making it easier for most investors to look back and make investment decisions rather than looking ahead. The most common mistake made by people in the capital market is "arriving at the peak and leaving at the bottom," which is rooted in always making decisions based on the "trend extrapolation" model. Little do they know that the most prominent feature of the cyclical nature of the capital market is that the pendulum will always reach its end and swing back.

In my 30 years of experience in the capital market investment, I have experienced five such winters. During each market bottom phase, similar phenomena can be observed: "Investors suffer severe losses + the economy seems to show no signs of improvement + the government cares about the stock market but there is no improvement + various voices saying 'this time is different' increase + cyclical companies' profits decline + fund sales freeze or investors are afraid to enter the market..." Of course, each time, there are different problems and difficulties, not completely identical. However, what remains the same is human nature, which tends to excessively amplify short-term risks and ignore positive factors during times of pessimism.

At this stage, similar to the past, there are two messages we want to convey to you: bad news and good news. The bad news is that the stock market has been in a bear market for three consecutive years (four years for the Hong Kong stock market), and many people have lost a significant amount of money. People are generally pessimistic about the economy and the stock market. The good news is that due to the decline in the stock market, stock valuations have become very cheap again. The stock market seems to have already reacted sufficiently to the bad news (some believe it has not reacted fully or has overreacted).

The green line in the chart represents the trend of the difference between the dividend yield of the CSI 800 constituent stocks and the yield of China's ten-year government bonds. It shows the attractiveness of investing in stocks for dividends compared to investing in government bonds. Historically, when the dividend yield is 1% lower than the yield of ten-year government bonds, it corresponds to an optimistic bubble phase in the capital market. It is also rare for the dividend yield of the CSI 800 constituent stocks to be more than 1.5% higher than the ten-year government bond rate, and this often coincides with important bottom ranges. In terms of asset allocation for Chinese yuan assets, the current attractiveness of the equity market is much greater compared to the past.

When it comes to investment, just like professional knowledge, it is important to respect common sense. In times of market pessimism and when valuations are cheap, it is advisable to actively enter the market. Gradually reducing positions and exiting when the market is optimistic and valuations are expensive may be the most correct and simplest investment principle, but it can be difficult for most people to follow. Most people may be aware of the problems in the economy and stock market, but they may not be clear or may overlook the more important question: has the capital market fully reflected these negative factors?

During challenging times, it is important to focus on positive factors and be prepared for a turnaround. During times of exuberance, it is important to consider potential risks and prevent a decline. There are still many positive factors accumulating in 2024. The authorities are believed to have given attention to the issues and difficulties in the real estate sector, and policies are gradually being strengthened. Stimulus policies to address insufficient domestic demand are also being prepared and implemented. The Federal Reserve's interest rate hike cycle is also coming to an end. With the adjustment of the US dollar index, the renminbi exchange rate has shown strong signs of recovery recently, and there are signs of easing in major power dynamics and international relations.

At this moment, both pessimists and optimists have sufficient arguments. It is unlikely that anyone can convince anyone else, nor is it necessary to convince anyone!

The capital market in 2024, will it go as the pessimists expect, into the abyss? Or will it turn around as the optimists anticipate? Everyone will have their own choices.

We choose to believe.

Believe in common sense! Believe in the diligence and goodness of the Chinese people, who are more diligent than the people of any other country, so their luck cannot be too bad!

Believe in the talent of Chinese entrepreneurs and their relentless entrepreneurial spirit, which is the most competitive in the world!

Believe in the power of cycles! Believe in the rules of the capital market!

Believe that even the coldest winter will come to an end, and after the winter, a new spring will surely arrive!

Wishing everyone a healthy 2024! Happy investing!

WU Weizhi

Jan 1st 2024

本期《偉志思考》簡體中文版鏈接:

伟志思考 | 2024年展望--这次不一样了or否极泰来

WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09WE Think — The Hardest Part of Investing: What to Do After Missing the Rally

In the current market environment, consensus on a bull market is gradually strengthening. The A-share market showed significant acceleration in August

2025-09-01