WE THINK | Why Did the Stock Market Accelerate Its Decline in January? How Far Is Spring Away?

- Category:偉志思考

- Edited by:Rabbit Fund

- Date:2024-02-05

January 2024 became the second worst January in history, with the CSI All A-Share Index dropping by 12.59% in a single month. Apart from January 2016, which experienced severe turmoil due to the circuit breaker mechanism, this January witnessed a significantly brutal decline in the A-share market. Thanks to support from mysterious forces, the heavyweight stocks in the market experienced relatively smaller declines, such as the Shanghai Composite Index and the CSI 300 Index, which dropped by -6.29% and -6.27% respectively. However, the small-cap stocks represented by the CSI 2000 Index plummeted by -20.97%, the ChiNext Index by -16.81%, the SSE STAR 50 Index by -19.62%, the CSI 50 Index by -22.52%, and the Hang Seng Tech Index by -20.15%. Essentially, except for high-dividend sectors becoming safe havens for funds and experiencing some warmth from the stable market, the entire market can be described as bone-chillingly cold.

The significant decline in the stock market has resulted in wealth losses, impacting various aspects of life. Even the popular restaurants in the once-bustling malls of Shenzhen have become quiet on Friday nights. Many investors who bought funds and stocks have experienced losses for three consecutive years, and the speed of losses in the first month of this year has even surpassed the entire previous year. One can feel the pain and despair within everyone's hearts. In this edition of We Think we will explore why small-cap stocks experienced a sharp decline at the beginning of the year, why the market has accelerated its decline after more than two years of continuous drops, and how investors should respond during such a phase.

Why did small-cap stocks experience a sharp decline at the beginning of the year?

In 2023, the majority of subjective bullish funds performed poorly, with the fund's major holdings experiencing a full-year decline of -15.67%, significantly underperforming the Shanghai and Shenzhen 300 Index, which recorded a decline of -11.38%. However, there were still a few funds that managed to achieve outstanding performance against the trend. We have also conducted preliminary research on the characteristics of these well-performing funds from the previous year. One category is deep-value funds, which have a higher exposure to factors such as high dividend yields and low valuation. Another category is skilled trading funds (including quantitative funds), which excel at strategic positioning. Given the high allocation of large-cap growth stocks by institutional investors, these funds capitalized on their expertise in avoiding heavily-weighted institutional and large-cap sectors, thereby increasing their allocation to small-cap stocks. We observed that these funds delivered relatively impressive performances last year, attracting more capital and further driving up stock prices, creating a localized positive feedback loop.

However, as the annual reporting season approaches, the performance and valuation of most small-cap companies are difficult to justify, leading to a significant increase in pressure for stock prices to decline during the earnings disclosure period. Furthermore, with a weak overall market beta at the beginning of the year and a lack of incremental capital, coupled with investors wanting to sell their positions without sufficient buyers, the narrative takes a dramatic turn. It transforms into a negative feedback loop where stock prices decline, triggering capital outflows, which further drives down stock prices, leading to additional capital outflows.

It has always been the case in the market that whenever fundamental investment strategies temporarily fail (during a phase of systematic and sustained decline), the atmosphere of speculative trading becomes the dominant theme. 2023 was considered a big year for thematic investments, and investors with strong trading skills in this style reaped rewards. They focused on AI themes at the beginning of the year and shifted to small-cap themes in the second half. However, speculation ultimately does not create incremental value; it merely redistributes wealth among the participants in the game.

In the latter half of last year, during my discussions with institutions and channels, there was a general sense that actively managed funds had a very cold reception in terms of sales in 2023. The market was predominantly interested in quantitative funds, and many of these products were even in high demand, leading to restricted availability. At that time, some institutions asked me about the impact of quantitative investing on actively managed funds and whether there was a future for such funds. I responded by noting that the trading characteristics of the market in 2023 were quite apparent. In such an environment, long-term investors with low turnover rates may face temporary setbacks. Quantitative funds, on the other hand, have naturally benefited from their diversified holdings and inherent trading attributes in such a market environment. However, every investment style has its most comfortable environment and effective period. With 31 years of experience in secondary investments, I can testify that when a fund with a distinct style begins to be recognized and sought after by the masses, it may not be far from reaching the end of its comfort zone and effective period. Just like at the end of 2020, the most acclaimed fund managers were those focused on the liquor consumption or new energy carbon neutrality sectors. Investors who were attracted to them during their peak moments are now deeply troubled. The end of 2023 was a highlight for trading-oriented funds (including quantitative funds). Whether this style will experience another three-year cycle remains uncertain. Conversely, investment styles that have reached their most challenging phase may gradually turn the corner and experience a reversal of fortune.

Why did the market accelerate its decline? We believe it is due to three factors.

Since the beginning of 2024, the speed of market decline has noticeably accelerated. In just 24 trading days, the ChiNext Index has experienced a decline of -18.03%, approaching the full-year decline of -19.41% in 2023. The STAR 50 Index has seen a decline of -20.96%, significantly higher than the full-year decline of -11.24% in 2023. Many media outlets and self-media platforms have attributed this accelerated market decline to factors such as the bursting of the "snowball" effect, stock pledged repo transactions, and margin calls. However, I do not fully agree with these viewpoints. These are issues and phenomena that arise from the market decline, and while they exacerbate the downward momentum, they are not the core factors. We believe that the sustained market weakness and recent acceleration in the decline are mainly due to resonance among three factors: deteriorating expectations of the economic fundamentals, imbalances in stock market supply and demand, and the inherent characteristics of the capital market itself.

Stronger expectations of a downward spiral in economic fundamentals

Although it seems like GDP growth is still very strong from the just disclosed macro data for 2023, the downside expectations that the capital markets are reacting to are strong. Macro data is an aggregation of micro data, which is lagging and a posteriori. Macro monetary and fiscal authorities should stare at the leading indicators to study and judge, and make policy moves in advance. Former Federal Reserve Chairman Alan Greenspan introduced his most concerned about the data, is the employment rate and residents' income.

Why is there a strong downward expectation for the economy among the general public and the capital market? The screenshot from someone's WeChat Moments, which has widely circulated in chat groups, is quite representative. As for the future, people have their own perceptions of their income levels and whether their spending power has increased or significantly decreased. Each individual has their own understanding of their own situation, just like how one knows best the temperature of the water they drink. As a microeconomic entity, if property values plummet, stocks and funds suffer heavy losses, and income decreases, those without debt burdens are already struggling, and those with debts are in an even more difficult situation. They can only tighten their belts and cut back on expenses. While this may be the right approach for an individual, if a majority of people in society do the same, it will lead to a typical fallacy of composition. A reduction in one party's expenditures (including government spending) corresponds to a decline in sales for another party. If business revenue and profits decline, layoffs and pay cuts are inevitable to weather the economic downturn. If this cycle continues, how will the macro economy unfold? Many industries and listed companies that we have been monitoring faced enormous pressure on their performance in the last three quarters of the previous year. The speed of decline in their performance often exceeded the decline in stock prices, resulting in lower valuations as prices dropped further.

A significant decline in property prices, bankruptcies and liquidations of major real estate companies, and a sustained and substantial decline in the stock market are all characteristics of a major cycle. These phenomena require high attention and full efforts to address. The immediate priority is to make a firm determination and take strong measures to quickly halt the downward trend in asset prices, reverse expectations of declining asset prices, and reverse expectations of economic decline. The foundation lies in adhering to the economic fundamentals, and all policy operations at the technical level may prove futile and unsustainable without considering the underlying economic factors.

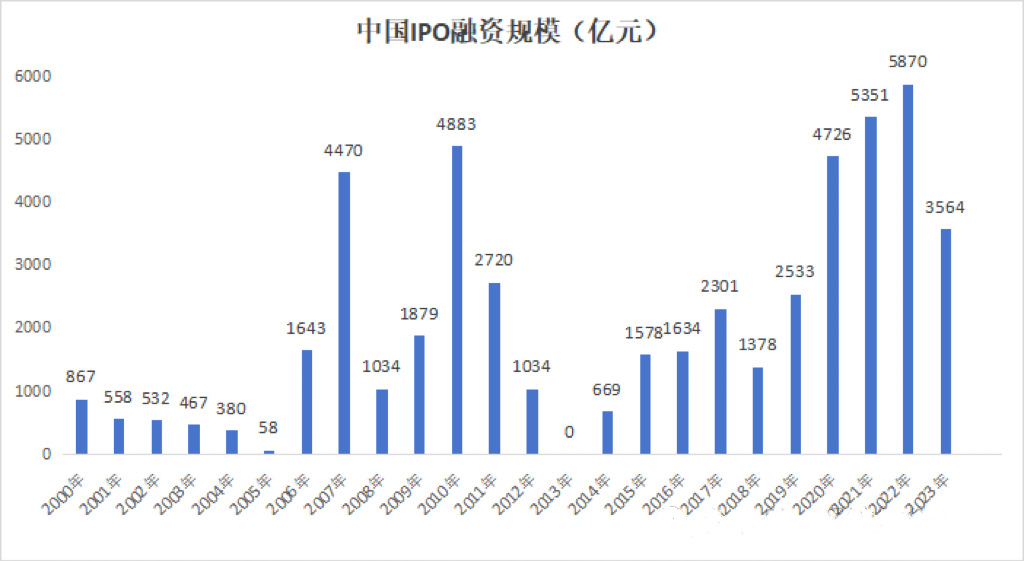

Lack of money-making effect in the stock market due to supply-demand imbalance

The past four years since 2020 have been a period of remarkable progress in which the stock market has supported the real economy. The annual number of IPOs in China during 2020-2023 was 399, 481, and 313 respectively. Over these four years, there have been over 1,600 IPOs, and currently, there are over 5,000 listed companies in China. This means that more than one-third of the companies have gone public in the past four years. The cumulative fundraising through IPOs in these four years has reached nearly 2 trillion Chinese Yuan. Additionally, with refinancing and reductions in holdings by major and minor shareholders, the market has experienced significant capital outflows in recent years. As time goes on, the increasing unlocking and reduction of shares held by restricted shareholders of these newly listed companies will exert enormous pressure on the market.

Although regulatory authorities have also accelerated the guidance of funds into the market and supported the issuance of various ETFs by public funds to meet the demand for the stock market, the increased supply within a few years has exerted enormous pressure on the market. This analysis does not yet take into account the diversion of funds caused by the Hong Kong Stock Connect and the establishment of the Beijing Stock Exchange, both of which have caused certain capital outflows. If various policies are further implemented to "revitalize" the Beijing Stock Exchange, it would be naive to expect that the market can simultaneously revitalize the Beijing Stock Exchange and stabilize and activate the capital market.

Although after July 2023, the regulator in order to stabilise the market, began to slow down the pace of IPO. But these four years has been issued to the stock supply has greatly exceeded the market's current capacity, supply and demand imbalance, the market price can only go down to find a new equilibrium, which in itself is the impact of supply and demand to determine the price of the economic laws at play.

Imbalance between supply and demand, the stock market has no money-making effect, the stock of funds under the game, although there are some phases of local money-making illusion, are not sustainable. In most investors continue to lose money under the feeling of stage stock market from no large-scale incremental capital inflow of the stock game into more and more money away from the market to reduce the amount of the game market.

The acceleration of the decline in the late stages of a bear market is itself one of the important patterns and common phenomena of the stock market.

Many investors are familiar with the popular emotional characteristics of the stages of bull market development summarized by Sir John Templeton (markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria). In my 31-year career in the secondary market investments, I have already experienced the bear market six times. Now, let's try to use similar language to analyze the process of the bear market from its inception to its end. This may help us better understand which stage this bear market has reached. The current market's divergence lies not in whether it is a bear market or not, but rather at what stage of bear market development it is (there are significant differences in overall and structural aspects). Will there be another bull market in the future? That remains to be seen.

In each bear market I have experienced, there have been several stages that can be summarized as follows: "The bear market gestates in frenzy, takes shape in uncertainty, develops in numbness, matures in pessimism, and ends in despair."

The reason why there is a frenzy is because one's holdings are making a lot of money or one has seen other prescient investments making big bucks on the space, and if you don't get on board and get involved, you'll miss out on a fantastic opportunity to make money. (Isn't it obvious that the consumer stocks and new energy track stocks at the end of 2020 have this characteristic?) Market frenzy in the name of the people, finally got on the car has the highest degree of public consensus in the most favorable areas of "quality assets", but do not know, this time has come to the climax of the bull market and the incubation period of the bear market. At this stage, investor sentiment is the key word - fanaticism.

Subsequently, it is discovered that these assets, unlike before when they kept rising, begin to experience a certain degree of downward adjustment. At this point, most investors would confidently believe that it is just a normal technical correction. After all, all analysts and media articles tell you that this is the future of the Chinese economy, something worth long-term optimism and holding onto like a long snowy slope (similar to early 2022 when some investors exclaimed, "If you don't invest in new energy now, it would be the same mistake as not buying real estate 20 years ago"). Investors at this stage may feel a bit conflicted. On one hand, various opinions and industry indicators are filled with positive and optimistic upward sentiment. However, for some reason, stock prices are showing a slight weakness. Although there are no sharp declines, the trend is gradually shifting towards a downward drift amidst volatility. The key phrase for investor sentiment during this stage is "uncertainty." Why does the theory and mainstream viewpoints support going long, yet the stock prices leave something to be desired? Perhaps it's just temporary market irrationality, and one should persevere.

Another characteristic of this stage is that investors' paper losses are not yet too severe (typically around 10%-30% in losses). As the bear market further develops and stock prices continue to decline (or fluctuate downwards), investors' paper losses become more significant. After experiencing losses of around 40%-50%, those investors who are going through a bear market for the first time adopt the following mindset: "Since it has already dropped this much, how much more can it possibly fall? As long as I hold on for the long term and don't sell, you won't be able to take advantage of me. There will always be a day when I can recover from this." The key phrase for investor sentiment during this stage is "numbness." Many people simply stop checking their stock and fund accounts, out of sight, out of mind. This may not be a big issue for investors who are not leveraged, but it can be highly risky for those who have borrowed money to invest.

As the bear market continues to unfold, it seems that there is an increasing flow of bad news, and the market begins to enter the pessimistic stage. Since stock prices have not experienced a major drop yet, there is still a glimmer of hope for some, and they haven't made up their minds to sell and exit. However, there are also investors who need cash or have lost confidence in their ability to recoup their investments, and they start to cut losses and exit the market. In a market that already has weak demand, even a small amount of selling pressure can lead to larger declines in stock prices.

As more people become pessimistic, the market experiences intensified selling pressure as investors are determined to sell and exit. Thus, the market transitions from the pessimistic state to the next stage, characterized by the keyword "despair." Stock prices enter a phase of accelerated decline. The increased speed of price declines leads to more leveraged funds facing forced liquidation. Investors in public and private funds also start redeeming their investments out of despair, causing these institutions to passively reduce their holdings through sell-offs. With weak buying pressure and a temporary increase in selling pressure, stock prices experience significant declines, as we have recently witnessed. Further declines trigger more selling from risk control mechanisms, stop-loss orders, and panic selling. In the short term, it seems like the market has entered a self-perpetuating downward spiral, where falling stock prices trigger more selling, leading to further declines, and so on, seemingly without end. However, both the extreme frenzy and despair phases are not sustainable in the long run. We have seen similar phenomena in late 2008, early 2016, and late 2018, and this is certainly not the first time, nor will it be the last.

Therefore, the accelerated decline that often occurs after a prolonged bear market is a characteristic of the late stage of each bear market. The underlying implication is the mindset of investors, which evolves from numbness and pessimism to despair and selling. Bulls may not survive, but the bear market persists! At this point, the market pendulum swings to the extreme of pessimism and despair. The arrival of the despair stage signifies something significant. It indicates that a new cycle is already entering its gestation period (if there is a cycle in the future stock market).

Near-term A-share Investment Strategies

In the short term, apart from a few large-cap stocks with low valuations and high dividend yields, which receive support from mysterious funds and institutional investors seeking safe-haven assets, there are slightly positive returns. Most stocks in the market exhibit indiscriminate declines, regardless of their performance or valuation. This phenomenon is similar to a geological disaster, such as a mudslide, where the occurrence of such a geological event does not last for an extended period. In the short term, it may indeed be crucial to prioritize ensuring safety. However, after ensuring safety, it is more important to prepare for the upcoming new cycle.

From a rational and dispassionate point of view, the accelerated decline of the market is not an increase in risk from a long-term perspective, but precisely an accelerated release of risk!

In terms of the portfolio, we are not exactly underweight, but our stability in the face of the January shock was still significantly better than the market. Benefiting from a higher proportion of the portfolio being allocated to high dividend, low valuation assets, this part of the portfolio has hedged against systemic shocks in the market, and high dividend assets are now in a range that has just moved from undervalued back into reasonable territory.

The terrifying aspect of a bear market is not just the loss of investors' money but the complete annihilation of their confidence. It is when the majority of people no longer have confidence that the situation quietly begins to change! This is why investing is so challenging, and why successful individuals will always be a minority.

Regarding this bear market and the subsequent bull market, there will be similarities and differences compared to the past. We have conducted extensive research and preparation (due to space limitations, I won't elaborate here) to understand these points. We want to emphasize that our preparation for this bear market is more comprehensive than for the previous five bear markets. Our strategy focuses on prioritizing short-term undervalued stocks with high dividends while actively preparing to increase positions in quality growth stocks.

Today is February 4th, the traditional Chinese solar term "Lichun" marks the beginning of spring on the calendar. Although the northern regions may still be covered in snow, spring has indeed arrived. I believe that the spring of the stock market will also quietly emerge amidst everyone's despair!

There are still 5 days to go before the Lunar New Year, I would like to wish all my friends an early Happy New Year!

Wish you all for the Year of the Dragon: Good Health and Good Wealth!

Wu Weizhi

February 2024

本期《偉志思考》簡體中文版鏈接:

伟志思考 | 股市一月份为何加速下跌?春天还有多远?

WE Think: How should we view the sharp rises and falls in gold and silver prices? Is the new Fed chair hawkish or dovish?

At the start of 2026, global politics, economics, geopolitics, commodities, and capital markets have experienced dramatic fluctuations, with many even

2026-02-02WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09