WE THINK: The Market is Developing Amidst Hesitations

- Category:偉志思考

- Edited by:Rabbit Fund

- Date:2024-04-01

In March, the A-share market experienced a consolidation phase following the sharp decline in January and the violent rebound in February. The overall market volatility decreased throughout the month. Before the 20th, the market showed a continuous strong upward trend with shallow corrections. However, after the 20th, there was a certain degree of market correction. The Shanghai and Shenzhen 300 Index saw a slight increase of 0.61% for the month, the Wind Complete A Index rose by 1.35%, and the Hang Seng Index increased by 0.18%. Although there are still significant differences of opinion among investors, both the optimists and pessimists are holding their positions. Nevertheless, the market has managed to break free from the abnormal trends of sharp declines and surges seen in January and February, and has started to recover with stability and relatively active liquidity in various aspects. It can be said that the attention given by the central government and the timely replacement of regulatory leadership, as well as the adjustment of regulatory strategies and phased work approaches, have begun to show positive effects.

This year, the real estate sector has remained weak in the first three months, and Vanke, a long-respected leader in the real estate industry, has recently been frequently involved in concerning negative rumors. The data from various aspects also brings mixed feelings. The export data and electricity consumption in the first two months were good, but personal income tax decreased by 15% compared to the previous year. In terms of bulk commodities, the non-ferrous metals sector has been strong, while the black metals sector has been bleak. This month, Wei Zhi is contemplating on the observations of the real estate industry, the impact of continued downward pressure on housing prices, and the potential changes in the stock market in a situation where the economy has not fully recovered its vitality.

Real estate sector urgently needs vigorous efforts to reverse the downward trend

From 2021 to 2023, China's real estate sector experienced significant declines in key indicators, with decreases of over 30%. New home sales area dropped from 1.8 billion square meters to 1.1 billion square meters, representing a decrease of 39%. Land transfer fees for the year decreased from nearly 8.7 trillion yuan to 5.8 trillion yuan (including a considerable amount absorbed by local government financing platforms), a decline of 34%. Land sales revenue is a major source of income for local governments, which has led to increased local debt risks and a decrease in local investment capacity. The negative impact on overall economic demand should not be underestimated.

The current challenges in the operation of the real estate market in China are caused by both demand-side and supply-side factors. A large number of real estate companies have faced debt crises or rumors, which raises concerns about whether homebuyers can trust purchasing properties under construction by these developers. I have heard from friends who have already made payments for properties from top developers in prime locations in Shenzhen, and they are currently experiencing regret and anxiety, fearing that the projects may be left unfinished. If buyers in prime locations of first-tier cities are feeling anxious, it can be imagined that the concerns in other areas are even greater. In the past year, the national second-hand housing market recorded approximately 5.96 million transactions, covering an area of around 570 million square meters, with a total transaction amount of 7.1 trillion yuan. The transaction area and amount increased by 44% and 30% respectively compared to 2022. In 2023, the combined sales area of new and second-hand homes amounted to approximately 1.51 billion square meters, with a total sales amount of around 17.4 trillion yuan, representing year-on-year growth of 6.3% and 5.8% respectively. The increasing proportion of second-hand home transactions conveys multiple messages. On one hand, there is still demand in the market. On the other hand, many properties sold in previous years were inventory transferred from developers to investment clients. The continuous increase in listings over the past two years suggests that the inventory held by investment clients is starting to loosen, increasing the pressure to liquidate their holdings. Overall, the concerns in the real estate market are driven by various factors, including debt crises, unfinished projects, and the dynamics among developers, buyers, and investors. It is important for potential buyers to carefully evaluate the credibility and financial stability of developers before making purchasing decisions.

As real estate companies' financial reports are being released one after another, the situation of A-share real estate firms is not optimistic. More than 36 companies have forecasted annual losses, and it is worth noting that the losses have spread from private real estate firms to state-owned and government-owned enterprises. On January 28th, CCCG Real Estate announced a switch from profit to loss, with a projected loss of 1.7 billion yuan in 2023. On March 1st, China Jinmao Holdings issued a profit warning announcement, estimating a loss of 6.7 billion yuan in 2023. On March 19th, Oceanwide Holdings released a statement anticipating a loss of 20-23 billion yuan in 2023. On March 28th, leading real estate company Vanke reported a profit of 12.163 billion yuan, a year-on-year decrease of 43.69%. Recently, international rating agencies downgraded Vanke's bond rating to junk status. These real estate companies that have disclosed significant performance declines or substantial losses are considered relatively better off within the industry. There are also some more troubled real estate companies that are unable to obtain audit firm signatures and therefore unable to release financial reports. Some have even entered bankruptcy restructuring. The collective challenges faced by a large number of real estate companies should not be underestimated. Many upstream construction suppliers are struggling with difficulties in maintaining their operations due to exploding accounts receivable. Although the direct exposure of state-owned financial institutions is not high in this phase of the real estate bubble and its burst, if the real estate sector continues to decline, resulting in broader downward pressure, state-owned financial institutions will not be able to escape unscathed.

The downward trend in real estate prices has implications beyond the aspects mentioned above. Drawing from the experiences of the negative asset crisis triggered by the Hong Kong property prices in 1997, the bursting of the real estate bubbles in the United States in 1929 and 2008, and Japan in 1992, the greatest and most enduring harm to the economy is inflicted on the balance sheets of residents' assets. According to studies using different methodologies, for most Chinese households, real estate accounts for approximately 60% of their total assets. A 30% decline in real estate prices would have varying impacts on households with different debt levels.

For a household with total assets of 10 million yuan and zero debt, the reduction in asset value by 1.8 million yuan may only result in a decrease in consumption demand. However, for homebuyers who have emptied their savings and put down a 30% down payment, a 30% decline in housing prices, coupled with bank interest, would mean that their years of hard-earned savings have been completely wiped out or even turned into negative assets (there are concerns that the 30% decline has not yet reached its bottom). If these unfortunate individuals also experience job cuts or salary reductions, they may struggle to afford their monthly mortgage payments, which explains the significant increase in foreclosed properties in recent years.

On the other hand, the increase in foreclosed properties and the financial strain of developers, forcing them to sell inventory at low prices, will further contribute to a decline in housing prices. In severe cases, such as the stampede witnessed in the stock market in early February, the consequences can be dire. Wise decision-makers should be proactive and prioritize measures to prevent stampedes and worsening negative feedback. Historical experience tells us that the cost of post-disaster reconstruction exceeds the efforts required to prevent the collapse of a building by far.

If housing price continues to fall, will the stock market crash?

NO! The answer is no. From the perspective of overseas history and experience, there is indeed a certain correlation between the development of housing prices and the stock market, but they are still relatively independent of each other. The fluctuation cycle of the real estate market is smoother compared to that of the stock market. In other words, the stock market has shorter cycles while the real estate market has longer cycles. During a long-cycle upward period in the real estate market, there will be multiple cycles of bull and bear markets in the stock market. Similarly, during a downward period in the real estate market, there will also be multiple cycles of bull and bear markets in the stock market.

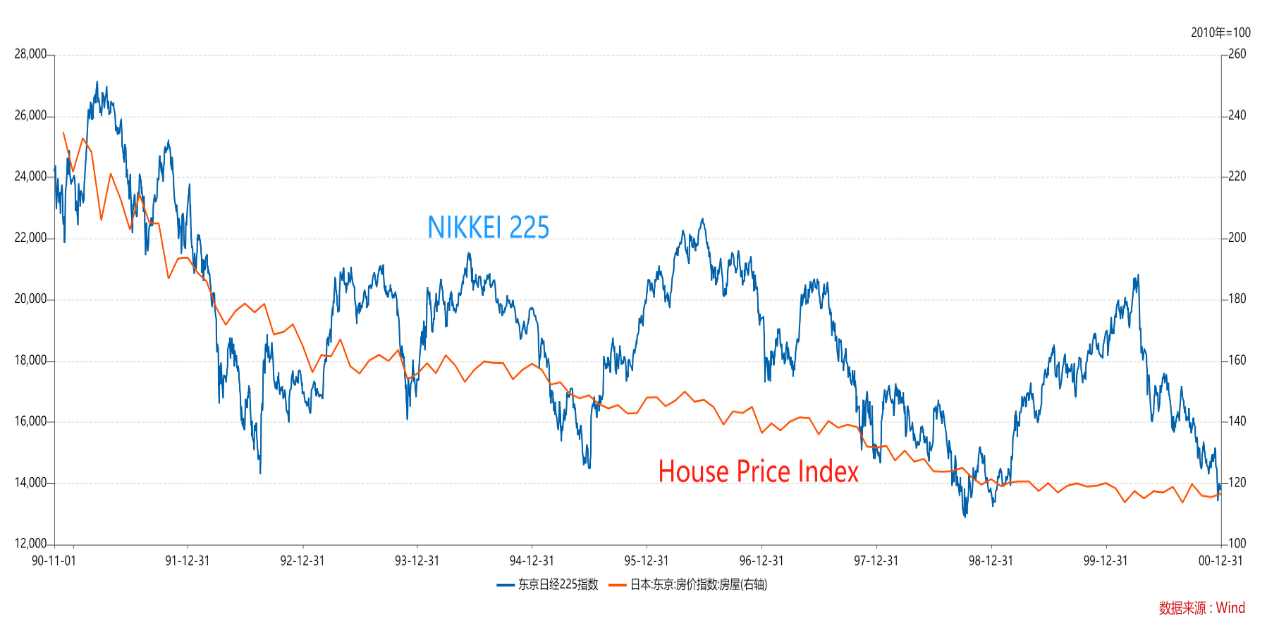

In the following chart, the orange line represents the housing price index in Japan from 1990 to 2000. It is evident that there was a continuous downward trend during this period. However, the stock market experienced three cycles of significant upward periods within the same decade.

Therefore, there is some rationale for concerns regarding real estate and the economy, but the stock market operates according to its own rules. Successful stock market investments depend on understanding these rules rather than engaging in debates about macroeconomics or unverifiable grand narratives.

Recent investment strategy

In the previous issue, we clearly stated that the bear market had ended, and after a month of observation, we have become even more confident in this judgment. Yes, the market has indeed exited the bear market phase and has entered a new cycle that calls for proactive actions.

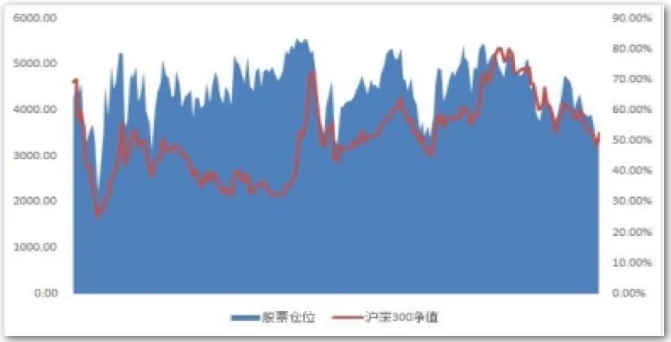

What is the current sentiment among market investors? There may be various perspectives on this observation. Here, I will utilize the Sunshine Private Equity Fund Position Index (CREFI) compiled by China Resources Shenzhen International Investment (CRSGII) since 2007 to gauge investor sentiment. The CREFI index shows that the average position of private equity funds stood at 50.17% at the end of February 2024, an increase of 1.99% compared to the previous month. Looking at the historical data spanning 16 years from 2007, the position of private equity funds has always reached its lowest level around market bottoms, with very few exceptions. Apart from the end of January 2024, the lowest position was observed at the end of 2008, indicating that although the market has started to rebound, overall confidence remains very low. This aligns with market patterns—"the market always develops amid hesitations!"

The market has exited the bear market phase, but it is not a comprehensive bubble bull market either. We apologize for not being able to provide excessive elaboration as we are buyers rather than financial advisors. We hope for your understanding and empathy. We will focus on promptly translating our research findings into optimized portfolios, and we believe that 2024 will be a rewarding year.

For those who hesitate about increasing equity asset allocation, we recommend daring to be among the few, daring to be contrarians even when fund sales are poor. Now is a good time to increase equity asset allocation.

The most failed paradigm in securities investment is "chasing the peak and turning away at the trough." This time, why not challenge the first-level thinking that has not been successful in the past and try the opposite approach. If there is still insufficient confidence, start with a smaller scale. "Buy a little during the trough with a compassionate heart, and step back when everyone is scrambling!" Perhaps the results of investment and financial management will undergo significant changes.

Weizhi Wu

Mar 31st, 2024

本期《偉志思考》簡體中文版鏈接:

伟志思考 | 行情在犹豫中发展

WE Think: How should we view the sharp rises and falls in gold and silver prices? Is the new Fed chair hawkish or dovish?

At the start of 2026, global politics, economics, geopolitics, commodities, and capital markets have experienced dramatic fluctuations, with many even

2026-02-02WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09