WE THINK: Chinese Equities Gaining Attention Again

- Category:偉志思考

- Edited by:Rabbit Fund

- Date:2024-05-06

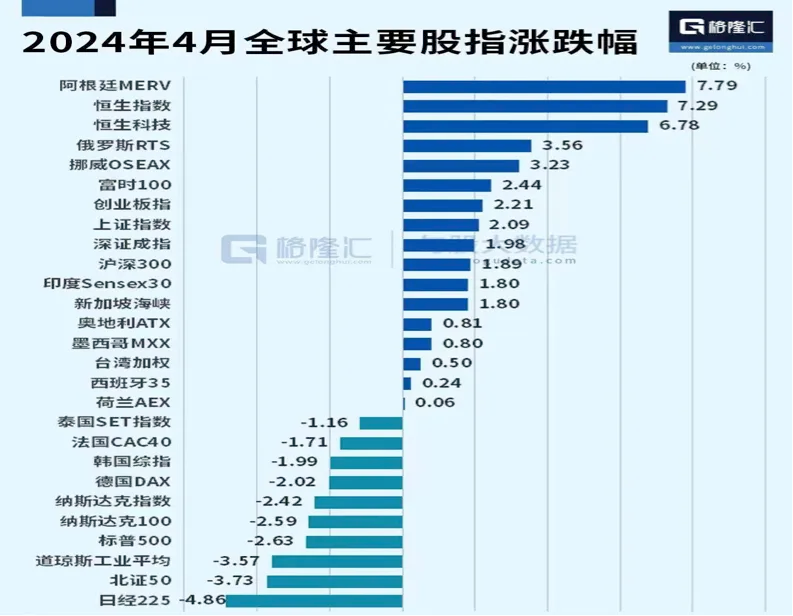

Amidst skepticism and various concerns, Chinese equity assets began to shine in April. Following a slight increase in March, the CSI 300 Index rose by 1.89% and the Shanghai Composite Index increased by 2.09% in April. Among Chinese assets, the Hong Kong stock market stood out with the Hang Seng Index and the Hang Seng Tech Index recording gains of 7.39% and 6.42% respectively in April. Since February, the Hong Kong stock market has seen three consecutive months of growth, and as we enter May, the pace of increase seems to be accelerating. In contrast, the US and Japanese stock markets, which have always been favored by global investors, appeared at the top of the list of decliners in April. The Nasdaq and Nikkei 225 indices dropped by 4.41% and 4.86% respectively in April. In addition, the Japanese yen depreciated against the US dollar by 11.66% by the end of April, indicating that the situation of fiercely competing with China to invest in Japanese stocks may not be as promising.

In addition to buying Hong Kong stocks, foreign capital has gradually warmed up and regained momentum through the Shanghai-Hong Kong Stock Connect program this year. As of April 25th, net inflows from northbound funds have exceeded 49 billion yuan, surpassing the total net inflow for the entire year of the previous year. On April 26th, following the release of US first-quarter data, northbound funds in the Shanghai and Shenzhen stock markets unilaterally purchased 22.449 billion yuan throughout the day, setting a new record since the launch of the Shanghai-Hong Kong Stock Connect program. During the domestic May Day holiday, on the 2nd and 3rd trading days in the Hong Kong stock market, the Hang Seng Tech Index and the Hang Seng Index rose by 7.31% and 4.01% respectively. Despite the absence of southbound funds due to their holiday, Hong Kong stocks experienced a long-awaited surge. From the above observations, it is undoubtedly a sign that overseas capital is beginning to embrace Chinese assets once again!

We will discuss the phenomenon of international investors temporarily leaving the US and Japanese stock markets and refocusing on Chinese assets, as well as the underlying logic behind it. We will also explore why Chinese core assets entered a bear market lasting three years starting in 2021, and why undervalued high-dividend assets have gained popularity for discussion.

Over the past three years, from 2021 to 2023, a group of growth-oriented fund managers in the A-share market have experienced a period of underperformance. Many investors who invested in these funds between the second half of 2020 and the first half of 2021 were somewhat disappointed. Several leading companies in the consumer and healthcare sectors, such as Haitian Flavoring & Food, Jinlongyu, China Duty Free Group, and Aier Eye Hospital, which were highly regarded by the market at the end of 2020, have seen their stock prices halved over these three years, experiencing significant declines.Weren't these companies considered the best in their industries? Weren't they excellent companies in the market? Why did holding these companies for two to three years result in scars, exhaustion, and financial difficulties?

As a result, some people claim that value investing has failed and is not suitable for the Chinese market. I completely disagree with such a claim!

The bursting of the core asset bubble demonstrates the effectiveness of value investing principles.

There are also investors who argue that the significant decline in the stock prices of these core assets over the past three years is not a failure of value investing theory but rather a manifestation of the principles of value investing. I agree with this viewpoint! Many of our long-time followers might know that we used to favor investing in growth stocks. However, since the end of 2020, we have significantly reduced the allocation weight of growth companies in our portfolio and increased the allocation weight of undervalued value stocks. The reason behind this change is that the valuations of industry-leading growth stocks had become significantly inflated. Many companies were trading at price-to-earnings ratios of forty or fifty times, or even higher, despite their earnings growth being around 15-20%. This deviation from investment norms was evident. On the other hand, due to the majority of the flows and funds chasing after core assets, there was a suction effect, leading to many value-oriented companies being excessively undervalued. The price-to-earnings ratios of many companies were only three to five times, and when considering their valuation after deducting net cash, they became even cheaper. From the perspective of acquiring companies, they became very attractive investments.

At the end of 2020, we witnessed a situation where core assets were widely sought after by the entire market, resulting in severe valuation bubbles. On the other hand, high-dividend value stocks were completely ignored, with their valuations reaching extremely cheap levels. People said they didn't know when these stocks would start to rise, and no one was willing to buy them. At that time, there were significant internal disagreements and debates regarding whether to increase the allocation of value stocks. However, common sense prevailed. If we adhere to Warren Buffett's statement that "A good company at a reasonable price," and approach investments from the perspective of acquiring a company outright, it becomes easier to reach a consensus to abandon overvalued star stocks and reallocate to undervalued value stocks that are worth acquiring.

In making an investment decision, there are two key factors. The first is qualitative analysis, which involves determining whether a company is excellent in its respective field (both growth stocks and value stocks should be evaluated based on their own criteria and not compared directly). The second is quantitative analysis, which involves determining the appropriate valuation for the company.

In today's era of information explosion and AI, almost every investor can quickly access a wealth of knowledge from around the world. Therefore, it is often not difficult to assess the prospects of an industry or determine if a company is the best in its industry. The challenge lies in the second factor. If most investors are aware of a good company and make investment decisions and actions based on that knowledge, resulting in expensive or even overvalued stock prices, should one continue to buy? For most non-professional investors and even many professional investors, the second factor presents a significant challenge (due to space limitations, we will not delve into how to address this issue here).

According to Howard Marks' theory, knowing whether something is good or bad represents first-level thinking. Understanding the extent to which market prices have reacted to these assessments, whether it is underreacting, appropriately reacting, or overreacting, is the key to second-level thinking!

The re-embracement of Chinese assets by foreign investors could be seen as a manifestation of the effectiveness of value investing principles.

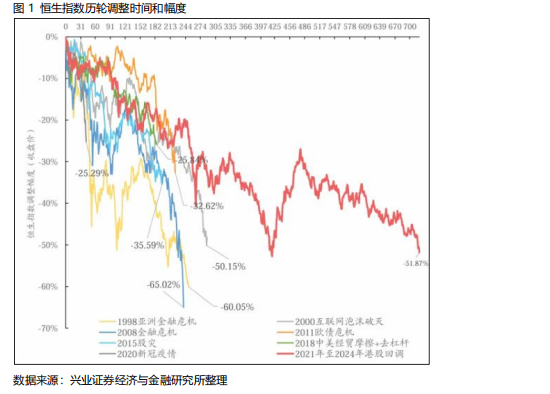

In regards to the current reality of global capital markets, it is widely known that the economies of the United States and Japan are currently "booming." However, it is unclear whether the stock markets in these countries have underreacted, appropriately reacted, or overreacted to this well-known "boom." Previously, many overseas investors expressed concerns that the Chinese real estate sector would weigh down the Chinese economy. However, the Hong Kong stock market has experienced a continuous and significant decline for four years, starting from its peak in 2018. The magnitude and duration of this decline are unprecedented. In the face of a four-year bear market, regarding the "potential drag" of real estate on the Chinese economy, has the capital market underreacted, appropriately reacted, or overreacted?

As shown in the chart below, it is evident that compared to previous bear markets in history, the duration and magnitude of this bear market in the Hong Kong stock market have been very substantial. If an investor has lost faith in the cyclical nature of the stock market, with its periods of prosperity and decline, then there may indeed be no need to discuss the topic of the stock market further.

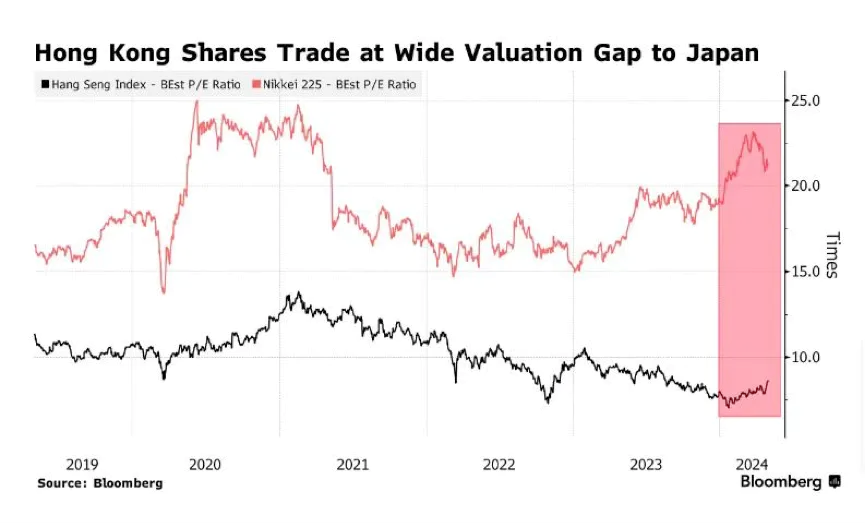

The question of whether to invest in the US and Japanese stock markets or Chinese assets is subjective and depends on individual perspectives. Regarding the US and Japanese stock markets, we believe that current valuations have already given a very substantial, and possibly even excessive, reaction to the state of the economy (without going into further discussion here). As for high-quality Chinese assets in the Hong Kong stock market, our viewpoint is clear: the market has overreacted. From a medium to long-term perspective, every instance of such irrational overreaction presents an opportunity for long-term investors to benefit.

After experiencing a four-year bear market, the valuation levels in the Hong Kong stock market have reached their lowest levels among major global markets. The Hang Seng Index is currently valued at just over 8 times earnings, while major US stock market indices are valued at over 25 times earnings, placing them at historically high levels from a long-term perspective. Japanese market valuations are also above 20 times earnings. In contrast, the valuations of Hong Kong-listed stocks, which are predominantly comprised of Chinese assets, are at historically low levels.

In early April, the China Securities Regulatory Commission (CSRC) announced five measures to enhance cooperation with Hong Kong, including expanding the scope of ETF products, including REITs, supporting RMB trading counters, optimizing mutual recognition of funds, and facilitating access to financing channels for IPOs. These new regulations help facilitate the connectivity mechanism between the two markets, attracting capital inflows and improving liquidity in the Hong Kong capital market. Foreign banks, including UBS and Goldman Sachs, have recently raised their investment ratings and allocation recommendations for Chinese assets. Additionally, the precise and robust support policies from the central government, along with improving and predictable US-China relations, are becoming catalysts for positive market sentiment.

Ultimately, the decision on whether to invest in US and Japanese stocks or Chinese assets should be based on careful analysis, individual risk tolerance, and long-term investment objectives. It is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Overseas capital with global allocation capabilities is gradually moving away from overvalued Japanese and American equity assets and embracing undervalued Chinese assets. Could this situation be similar to the movement of funds towards high dividend and undervalued assets seen in early 2021? When we look back on this period in a few years, could we conclude that this is another typical case highlighting the effectiveness of value investing principles?

Perhaps in the near future, many investors will regret on missing out an opportunity of a lifetime. But isn’t it better to take timely action and make the most out of present opportunities than later?

Recent Investment Strategies

At the end of February, we made it clear that the bear market had ended. By the end of March, we became even more confident in this assessment, stating that the market was developing amidst some hesitation. Another month has passed, and the market's development continues to align with our previous predictions.

Although the A-share market appears to have rapid sector rotation and has not yet formed a bullish sentiment, there may not be significant wealth effects for those who engage in frequent trading. However, within the overall market's oscillating upward trend, several high-quality themes have exhibited stronger upward momentum and smaller pullbacks. The net asset values of most of our products have also reached new highs for the year amidst market fluctuations.

During this stage, it is particularly important to avoid overstimulation. Just as crops need sufficient time to grow, it is essential to give investments enough time to mature. Expecting significant gains in just one or two weeks demonstrates a lack of understanding of the regularities of cultivation and investment. After sowing the seeds, patience is required to await their growth and maturity. Transitioning from the low-temperature zone of the bear market bottom to the high-temperature zone of harvest requires patience and discipline.

In terms of structure, we embrace several key themes that we believe have strong potential. The core keyword is "excellent companies," where the prices have already reacted excessively or at least reasonably to the bear market.

At this moment, it is suitable to revisit Warren Buffett's famous quote: "Don't wait until economic data turns positive to buy stocks; by then, you will have missed out on the market's big rally." Even overseas capital is starting to regain interest in and confidence in Chinese assets. So why should we still hesitate?

Regards,

WU Weizhi

May 4th, 2024

本期《偉志思考》簡體中文版鏈接:

伟志思考|中国资产为何重新成为香饽饽?

WE Think: How should we view the sharp rises and falls in gold and silver prices? Is the new Fed chair hawkish or dovish?

At the start of 2026, global politics, economics, geopolitics, commodities, and capital markets have experienced dramatic fluctuations, with many even

2026-02-02WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09